What led to a global imbalance of available shipping containers? And what were the effects on U.S. businesses?

Never underestimate the American consumer. As businesses shuttered and unemployment rose in 2020, people kept buying things. Spending shifted from services like dining and movies to physical, tangible goods, and supply chains kept pace by placing orders from suppliers.

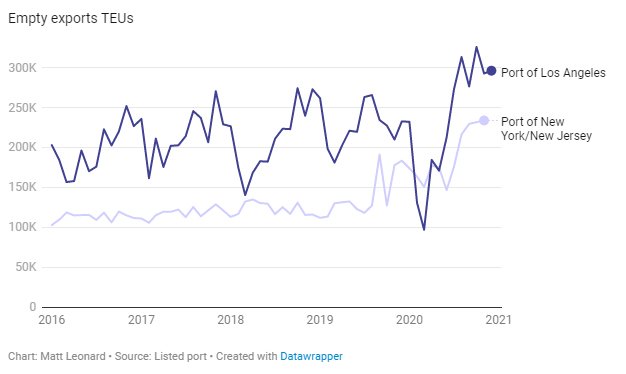

Imports surged, and so did the need for containers. To keep up with demand, ocean carriers prioritized shipments out of Asia for U.S. or European imports. This led to an uptick in empty containers leaving U.S. ocean ports as carriers didn’t wait for U.S. exporters to load their goods and instead prioritized more profitable businesses in Asia.

“Any empty container [ocean carriers] get, they want to bring back to Asia as fast as they can,” Agriculture Transportation Coalition Executive Director Peter Friedmann said in an interview at the end of 2020.

The issue has continued into 2021, according to Port of Los Angeles Executive Director Gene Seroka, who said the imbalance of containers started in March 2020 when empty containers began to pile up at the port due to blank sailings. MSC and Maersk used sweeper ships to help reposition the containers to Asia as factories in China began to reopen.

“What we have seen since then, is that some have focused on getting those empties back [to Asia] as quick as possible because it cuts down the overall transit time compared to an export,” Seroka said.

Exports of empty containers surge on high demand

In fact, there are signs the market is making it even more difficult for U.S. exporters to access equipment.

“It’s actually gotten worse, some carriers are currently shipping over 75% of their containers empty back to Asia to make sure they get there faster,” Flexport VP of Ocean Freight Nerijus Poskus said in an email.

The result is that exporters are still struggling to find equipment, though some have suggested the network could find balance as early as next month.

The finances don’t work in exporters’ favor

An ocean carrier will make more from transporting a loaded export compared to an empty in terms of that single transaction. But when the market is tight, a carrier is thinking about more than a single transaction, considering variables like the dwell for that container and how long it will take to get it back. When all this is considered, it can make more sense for carriers to prioritize empty containers over full exports.